Experts break down ‘blatant’ lies in email sent after Trump signed ‘big beautiful bill’ into law

A recent bill signed into law by Donald Trump has stirred up a lot of debate, and experts are calling out what they say are misleading claims about it—especially in a government email that followed the bill’s signing.

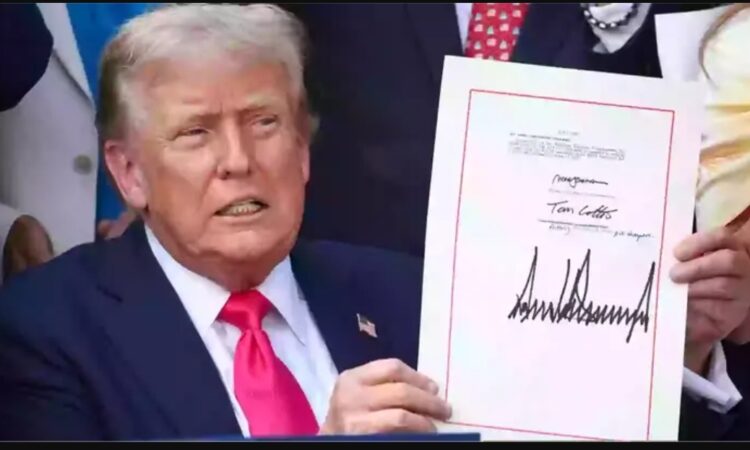

On July 4th, during an Independence Day rally in Iowa, Trump proudly announced that Congress had passed what he called his “big, beautiful bill.” The bill passed by a very narrow margin—just four votes—and Trump celebrated it as a major step toward fulfilling his campaign promises to “make America great again.”

The bill is nearly 1,000 pages long and includes large tax cuts that Trump had promised during his 2024 presidential campaign. However, critics are concerned about the bill’s impact on the national debt—it’s expected to add around \$3.4 trillion to it over the next 10 years. That’s a big deal, considering the debt already stands at \$36.2 trillion. The bill also includes cuts to programs related to healthcare and food safety, which many view as essential services.

After the bill was passed, the U.S. Social Security Administration (SSA) sent out an email saying the new law would eliminate federal income taxes on Social Security benefits for most recipients. This statement caused an immediate backlash, with some experts and lawmakers calling it completely false.

Frank Pallone, a Democratic congressman from New Jersey, didn’t hold back. He posted on social media that “every word” in the SSA’s email “is a lie.” He said it was troubling that a normally neutral government agency like the SSA appeared to be used to spread political misinformation.

Experts, including Kathleen Romig—who used to work at the SSA under President Biden—explained that the bill doesn’t actually get rid of taxes on Social Security benefits. In fact, due to the specific rules involved in passing this kind of legislation, such a sweeping tax change isn’t even possible in this case.

Instead of eliminating those taxes, the bill gives a temporary tax deduction. Seniors aged 65 and older can get up to \$6,000 off their taxes, and married seniors can get up to \$12,000. But even those benefits aren’t for everyone. They begin to phase out if an individual makes over \$75,000 or a couple makes over \$150,000 per year.

Romig added that the way the Trump administration presented the bill was misleading and sounded more like a campaign message than a factual government update. She said some people were confused by the email and even wondered if it was a scam because it didn’t sound like a typical government announcement.

In the end, while the bill does include some tax relief for seniors, it falls far short of the sweeping promises made in that controversial email—and many feel the public deserves a clearer, more honest explanation.