Social Security is a program that helps millions of people in the United States, especially older adults who have retired from working. For many of them, it’s one of the most important sources of money they have. As of August, more than 53 million retired workers were getting Social Security payments, and the average monthly amount was about $2,008.

That may not sound like a lot of money, but for many older people, it’s what helps them pay for the basics—like food, rent, medicine, and electricity. In fact, about 80% to 90% of retirees use this money to help cover their everyday expenses. Without Social Security, a lot more older people would be living in poverty, struggling to afford even the essentials.

Social Security isn’t something that stays the same forever. The government updates the program often. The Social Security Administration, which runs the program, looks at the economy, costs of living, and other factors every year and makes changes. These updates can affect how much people get, who qualifies, and what the rules are.

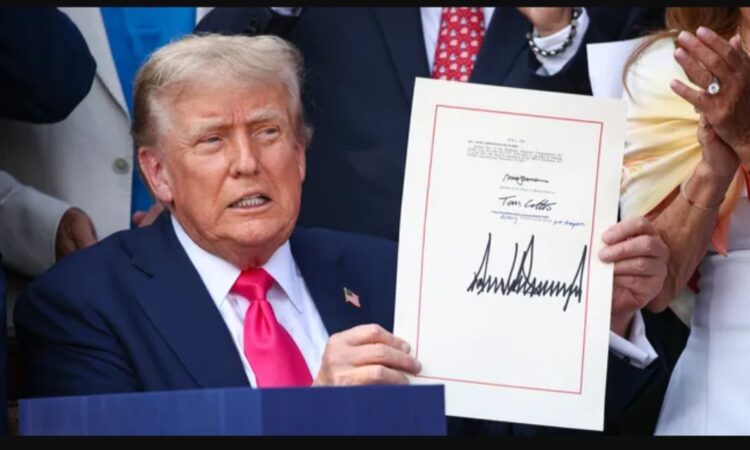

But it’s not just the Social Security Administration that can make changes. Sometimes, the President can also make decisions that impact the program. For example, back in March, President Donald Trump signed an executive order that officially went into effect on September 30. This order permanently ended the use of paper checks for Social Security payments. Since 1940, many people had been getting their monthly benefits through checks in the mail. That system is now officially over.

Most people won’t be affected by this change because nearly everyone—more than 99%—already gets their Social Security payments directly into their bank accounts or on prepaid debit cards. However, there were still around 390,800 people as of September 2025 who were receiving paper checks. Those people now need to switch to a digital payment method in order to keep receiving their money.

The government made this change to save time, reduce problems, and cut down on fraud. Paper checks take longer to arrive and are more likely to be delayed, lost, or stolen. Plus, they cost more to print and mail. Each paper check costs about 50 cents to produce and send, while an electronic payment costs less than 15 cents. By switching everyone to digital payments, the government expects to save over $2 million each year, which can be used for other parts of the Social Security program or to help improve services.

If you’re someone who still gets a paper check, you now have two ways to receive your Social Security benefits. One option is direct deposit. This means your monthly payment goes straight into your bank or credit union account. You can sign up for this online by creating a “my Social Security” account, or you can go in person to a Social Security office. Many banks can also help set this up for you. The other option is the Direct Express card. This is a prepaid debit card provided by the government. If you don’t have a regular bank account, this card works just like any other debit card and your benefits will be loaded onto it every month. You can use it to buy things, pay bills, or take out cash.

More changes are coming soon. On October 15, the Social Security Administration is expected to announce its yearly updates, which will take effect in January 2026. One of the biggest updates people are waiting for is the cost-of-living adjustment, often called COLA. This is an increase in Social Security payments to help people keep up with rising prices. Every year, the government looks at inflation—how much prices for things like food, housing, and healthcare are going up—and uses that to decide how much to increase Social Security checks.

Experts believe the COLA for 2026 will be around 2.7% to 2.8%. That means people might see a small increase in their monthly checks to help them deal with higher prices. If that happens, it will be the fifth year in a row that the COLA has been above 2.5%. That kind of steady increase hasn’t happened since the 1980s and 1990s, so it’s a big deal for people who depend on Social Security to get by.

However, even though checks may go up a little, it doesn’t always feel like extra money. That’s because other costs are rising too. Medicare Part B premiums—which cover things like doctor visits—are expected to go up by about 11.5%. On top of that, prices for housing and healthcare are increasing. So even though you might get a slightly bigger check, much of that extra money may be used up by higher bills and living expenses.

There are also some expected changes for people who earn higher incomes. Right now, only income up to $176,100 is taxed for Social Security purposes. That number is expected to go up in 2026. This means that people who earn more than that amount will have to pay more in Social Security taxes. At the same time, the maximum amount someone can receive from Social Security each month—currently $4,018 for people retiring at full retirement age—is also likely to increase.

All these changes show that Social Security is a program that continues to adapt. The rules are always being updated to match what’s happening in the economy, with technology, and in government. Whether it’s a decision made by a President or regular updates from the Social Security Administration, the program is always moving. It’s important for people especially retirees and others who depend on these monthly payments—to stay informed and understand how these changes might affect them. For many Americans, Social Security is more than just a check—it’s the foundation of their financial security in retirement.

Those supoosed kickbacks are worthless