The world of finance is present process speedy transformation, pushed by technological developments, regulatory modifications, and shifting client behaviors. Over the following decade, the monetary panorama is predicted to evolve in methods that may reshape industries, redefine the roles of economic establishments, and create new alternatives for people and companies alike. From the rise of decentralized finance (DeFi) to the rising use of synthetic intelligence (AI) in funding methods, the way forward for finance guarantees to be each thrilling and difficult.

This text explores the important thing tendencies that may form the finance sector within the coming decade, masking technological improvements, regulatory developments, and rising monetary fashions. It’s going to additionally study the impression these tendencies can have on companies, shoppers, and the worldwide financial system.

The Rise of Decentralized Finance (DeFi)

What’s Decentralized Finance (DeFi)? Decentralized finance (DeFi) refers to a brand-new monetary ecosystem constructed on blockchain expertise, the place conventional monetary providers like lending, borrowing, buying and selling, and asset administration are offered without intermediaries like banks. DeFi platforms function on decentralized networks, providing customers better management over their belongings and lowering reliance on centralized establishments.

DeFi has already gained important traction lately, with platforms like Uniswap, Compound, and Aave attracting billions of {dollars} in belongings. Because the expertise matures, DeFi is predicted to play a good bigger position within the monetary business, difficult conventional monetary establishments and providing new alternatives for traders.

Key Options of DeFi:

Transparency: All transactions are recorded on a public blockchain, making monetary processes extra clear.

Accessibility: DeFi platforms are accessible to anybody with an web connection, eliminating obstacles similar to geographic restrictions and creditworthiness.

Decrease Prices: By slicing out intermediaries, DeFi reduces transaction prices, making monetary providers extra inexpensive.

Table 1: Comparison Between Traditional Finance and Decentralized Finance (DeFi)

| Aspect | Traditional Finance | Decentralized Finance (DeFi) |

|---|---|---|

| Intermediaries | Banks, financial institutions | No intermediaries |

| Accessibility | Restricted by location, credit score | Global, open to all |

| Transaction Speed | Slow (days for settlement) | Fast (minutes to hours) |

| Transparency | Limited | Full transparency on blockchain |

The Way forward for DeFi

Over the following decade, DeFi is predicted to increase past cryptocurrency lovers and entice mainstream customers. As regulatory readability improves and safety considerations are addressed, DeFi platforms may develop into a viable different to conventional banking and monetary providers. As well as the combination of DeFi with different rising applied sciences, similar to synthetic intelligence (AI) and Web of Issues (IoT), may result in the creation of recent, modern monetary merchandise.

Nonetheless, challenges stay, together with regulatory uncertainties, safety vulnerabilities, and the necessity for consumer training. Addressing these points will likely be essential for the widespread adoption of DeFi within the coming years.

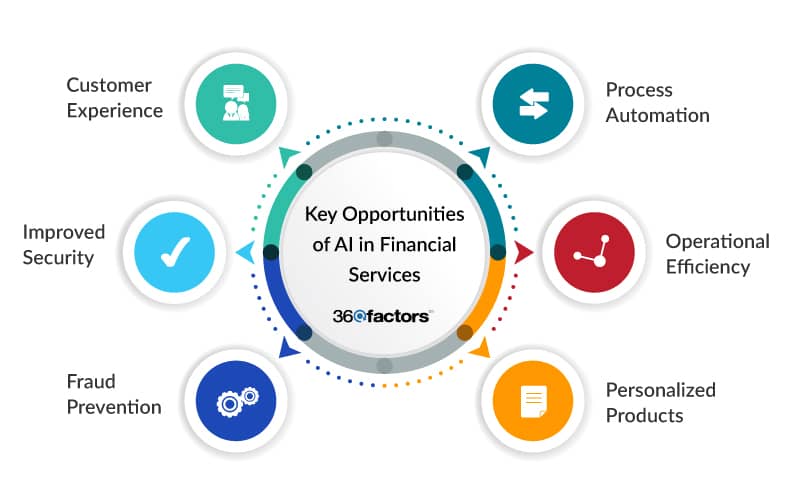

AI-Pushed Monetary Companies: Synthetic intelligence (AI) is revolutionizing the finance sector by automating processes, enhancing decision-making, and enhancing buyer experiences. From AI-powered chatbots in customer support to machine studying algorithms in buying and selling, AI is remodeling the way in which monetary establishments function.

Some of the important purposes of AI in finance is predictive analytics. AI can analyze giant datasets to establish patterns, tendencies, and dangers, serving to monetary establishments make higher choices. For instance, AI-driven credit score scoring fashions can assess creditworthiness extra precisely than conventional strategies, lowering default charges and rising entry to credit score for underbanked populations.

AI in Funding Administration: AI can be remodeling funding administration by automating portfolio administration and optimizing buying and selling methods. Robo-advisors, which use AI to offer customized funding recommendation, have gotten more and more common amongst retail traders. Moreover, AI-driven hedge funds and institutional traders are utilizing machine studying algorithms to investigate market information and execute trades in actual time.

Table 2: Benefits of AI in Finance

| Application | AI Benefits | Impact on Finance |

|---|---|---|

| Credit Scoring | More accurate risk assessment | Improved credit access, reduced defaults |

| Customer Service | Automated chatbots, 24/7 support | Enhanced customer experience |

| Investment Management | Algorithmic trading, robo-advisors | Increased efficiency, reduced costs |

The Way forward for AI in Finance

As AI expertise continues to evolve, its position in finance will develop into much more distinguished. Within the subsequent decade, we are able to count on AI to drive additional innovation in areas similar to fraud detection, compliance, and threat administration. Moreover, the combination of AI with different applied sciences, similar to blockchain and quantum computing, may unlock new prospects for monetary providers.

Nonetheless, the widespread adoption of AI in finance additionally raises considerations about job displacement, information privateness, and moral issues. Monetary establishments might want to navigate these challenges fastidiously to make sure that AI is used responsibly and ethically.

What’s Sustainable Finance? Sustainable finance refers to monetary actions that take environmental, social, and governance (ESG) elements under consideration. Because the world faces rising challenges associated to local weather change, social inequality, and company governance, traders and monetary establishments are more and more prioritizing sustainability of their decision-making processes. The demand for sustainable finance merchandise, similar to inexperienced bonds, social impression investments, and ESG-focused funds, has surged lately. Based on a report by the World Sustainable Funding Alliance, world sustainable funding reached $35.3 trillion in 2020, and this determine is predicted to develop considerably within the coming decade.

The Position of ESG in Funding Choices

ESG elements have gotten a vital part of funding methods. Traders are more and more in search of alternatives that align with their values whereas additionally delivering monetary returns. Corporations that display robust ESG efficiency are sometimes perceived as much less dangerous and extra resilient in the long run, making them enticing funding targets.

Table 3: Key ESG Factors in Investment Decisions

| Category | Factors Considered | Impact on Investment |

|---|---|---|

| Environmental | Carbon footprint, energy efficiency | Lower risk from climate regulations |

| Social | Labor practices, community engagement | Improved reputation, customer loyalty |

| Governance | Board diversity, transparency | Stronger corporate governance, reduced legal risks |

The Way forward for Sustainable Finance: The following decade will see continued development in sustainable finance as traders, regulators, and shoppers place better emphasis on ESG elements. Monetary establishments might want to develop new services and products that cater to this demand, whereas additionally making certain that they meet evolving regulatory necessities. Moreover, developments in expertise, similar to AI and blockchain, may improve the transparency and accountability of ESG reporting, making it simpler for traders to evaluate the sustainability of their investments.

The Rise of Central Financial institution Digital Currencies (CBDCs): Central banks all over the world are exploring the event of digital currencies, generally known as Central Financial institution Digital Currencies (CBDCs). In contrast to cryptocurrencies like Bitcoin, that are decentralized, CBDCs are issued and controlled by central banks, providing a digital type of conventional fiat foreign money.

CBDCs have the potential to revolutionize financial coverage, funds, and cross-border transactions. By offering a safe, environment friendly, and clear technique of cost, CBDCs may cut back reliance on bodily money, streamline monetary operations, and improve monetary inclusion.

Cryptocurrencies and the Way forward for Finance

Whereas CBDCs characterize a government-backed method to digital foreign money, cryptocurrencies like Bitcoin, Ethereum, and stablecoins are additionally gaining traction as options to conventional fiat currencies. Cryptocurrencies provide a number of advantages, together with:

Decentralization: Cryptocurrencies function on decentralized networks, lowering the necessity for intermediaries.

Safety: Blockchain expertise gives a safe and clear option to switch and retailer worth.

Borderless Transactions: Cryptocurrencies allow cross-border transactions without the necessity for foreign money conversion or excessive charges. Nonetheless, cryptocurrencies additionally face important challenges, together with regulatory uncertainty, market volatility, and considerations about their environmental impression.

Fintech’s Influence on Monetary Companies: Monetary expertise (fintech) corporations are driving innovation within the finance sector, providing new methods to ship monetary providers and enhance accessibility. From cell banking apps to peer-to-peer lending platforms, fintech has reworked how shoppers and companies work together with monetary establishments.

Fintech has performed a very necessary position in enhancing monetary inclusion, offering entry to banking and monetary providers for underserved populations. In growing economies, cell cost platforms like M-Pesa have enabled thousands and thousands of individuals to take part within the formal monetary system, lowering poverty and fostering financial development.

The Way forward for Fintech

Over the following decade, fintech is predicted to proceed reshaping the monetary panorama, with developments in areas similar to AI, blockchain, and digital id verification. Fintech corporations will probably collaborate extra carefully with conventional monetary establishments, creating hybrid fashions that mix the strengths of each sector.

As well as fintech will play a key position in addressing world challenges similar to monetary inclusion, local weather change, and earnings inequality. By leveraging expertise to create extra accessible and sustainable monetary options, fintech has the potential to drive optimistic social and financial change.

The Evolving Regulatory Panorama: Because the finance sector undergoes speedy transformation, regulators are dealing with new challenges in making certain that monetary markets stay truthful, secure, and safe. Rising applied sciences, similar to AI, blockchain, and digital currencies, are creating new regulatory complexities that require up to date frameworks and oversight. Regulators are more and more targeted on points similar to information privateness, cybersecurity, and the moral use of AI in finance. As well as, governments are grappling with the right way to regulate decentralized monetary methods, together with cryptocurrencies and DeFi platforms.

The way forward for finance is ready to be formed by a mixture of technological developments, regulatory modifications, and shifting client preferences. Decentralized finance, synthetic intelligence, digital currencies, and fintech will play pivotal roles in remodeling the monetary panorama, providing new alternatives for companies and shoppers alike. Because the monetary business evolves, it is going to be important for regulators, monetary establishments, and shoppers to adapt to those modifications. By embracing innovation whereas addressing challenges associated to safety, privateness, and moral issues, the finance sector can construct a extra inclusive, clear, and sustainable future for all.

FAQs

What’s the way forward for decentralized finance (DeFi)?

The way forward for DeFi is promising, with the potential to disrupt conventional banking and monetary providers. Because the expertise matures and regulatory readability improves, DeFi platforms will probably achieve wider adoption.

How will AI impression finance within the coming decade?

AI will proceed to revolutionize finance by automating processes, enhancing decision-making, and enhancing buyer experiences. AI will play a vital position in areas similar to fraud detection, funding administration, and credit score scoring.

What is Central Financial institution Digital Currencies (CBDCs)?

CBDCs are digital currencies issued and controlled by central banks. They provide a digital type of fiat foreign money and have the potential to rework funds and financial coverage.

What’s the position of fintech in monetary inclusion?

Fintech has performed a key position in enhancing monetary inclusion by offering entry to banking and monetary providers for underserved populations. This development is predicted to proceed within the coming decade.

What are the important thing tendencies shaping the way forward for finance?

Key tendencies embody the rise of decentralized finance, the rising use of AI, the expansion of sustainable finance, the evolution of digital currencies, and the impression of fintech on monetary inclusion.